Link: Apple Pay Tries to Solve a Problem That Really Isn’t a Problem

That's the headline from a post on The Upshot today by Neil Irwin (@Neil_Irwin). The post starts with a humorous argumentum ad absurdum takedown of Apple's informercial-fail style spot for Apple Pay.

The non-problem, as Neil puts it, is that it's too difficult to use a credit card. He rightly points out that we often use our credit cards at points of sale several times a day, mostly without much difficulty.

While it's true that most magnetic-stripe-based transactions are carried out without major failures, that's not the same thing as saying they don't have problems. Even the smoothest credit card transaction involves some amount of hassle. And most points of sales require you to interact with poorly designed and constructed terminals (mainly in service of entering a PIN or "signing" your name). And, even if all of that goes completely smoothly (and quickly enough not to hold up the line at the grocery store), you still run the risk of having your card stolen, as I found out first hand with Target last Christmas.

But, it's not until his seventh paragraph that Irwin even mentions the security implications, and even then he downplays them. (His point is that European-style chip and PIN cards will provide the same security benefits without being tied to a particular payment vendor.) But what if security, not convenience, is the problem Apple Pay is trying to solve?

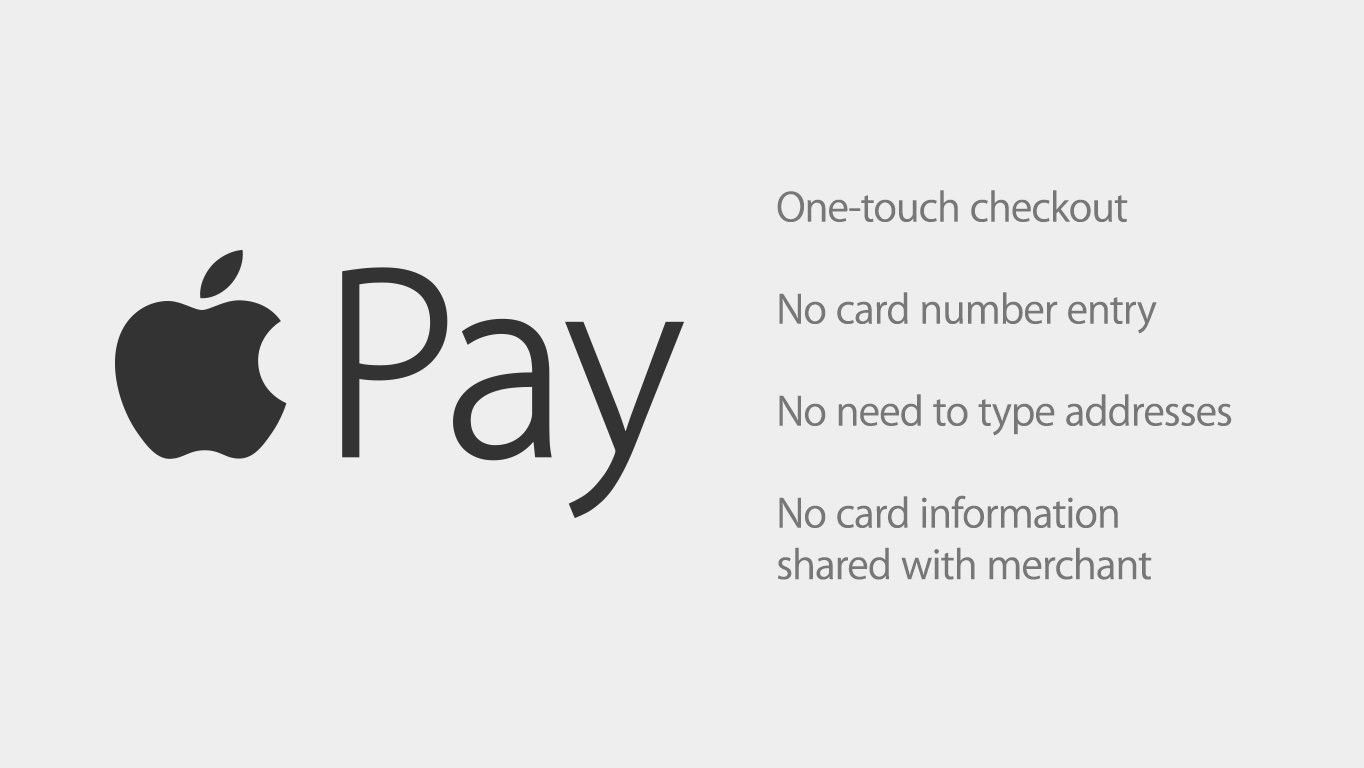

While NFC has been around for years now, to my knowledge, no one else has implemented it in the way Apple Pay does, conducting real-time transactions without sharing the customer's account number with the merchant (and without tracking your transactions a la Google Wallet).

Consumer convenience makes for a good commercial (hypothetically, anyway, if not in practice during yesterday's keynote), but the security implications (and Apple's negotiating prowess) are what will see it adopted in the market.